Text: Harald Czycholl

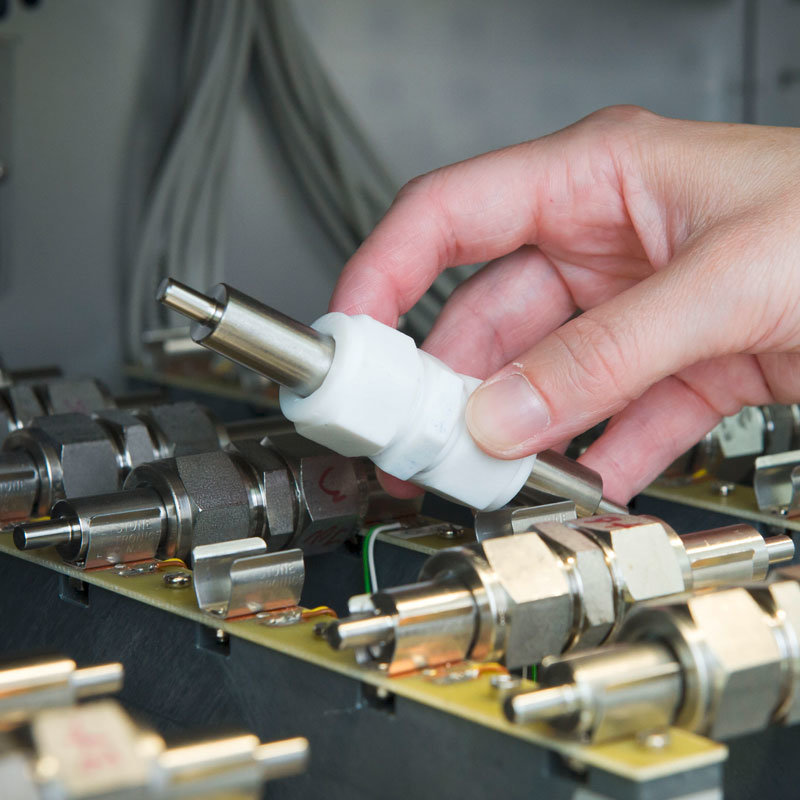

Photos: Helmholtz-Institut Ulm (HIU), BPW

Politicians and experts alike agree that electric vehicles are part of the future of mobility. Powerful batteries are the key element of electric vehicles. That’s why there is currently massive investment going into German battery research and production. While Asian companies are currently at the forefront of battery technology, this soon ought to change.

‘Batteries are the future,’ wrote Martin Winter, Professor for Physical Chemistry at the Westphalian Wilhelm University of Münster and head of the renowned MEET Battery Research Institute, in a guest column for the Berlin daily newspaper Der Tagesspiegel in May 2015. His article, which explained the state and potential of battery technology at the time, ended with a call to politicians: Germany could end up lagging behind in battery research and the country needed a national cell production industry.

Now, Winter can help ensure the progress of battery research in Germany himself: following a competition among locations, in the summer, the Federal Government of Germany decided to set up the research facility for battery cell production (FBB) in Münster under Winter’s leadership. The Federal Government is investing EUR 500 million in the site, while the state of North Rhine-Westphalia is contributing an additional EUR 200 million. ‘Mass production of large battery cells in Germany has so far been a missing link in key value chains involving use of energy storage – such as e-mobility,’ says Winter. ‘With our research into battery manufacture, we are building the necessary technological expertise.’

When it comes to battery technology, Germany needs to catch up

This is sorely needed, as electric vehicles are ultimately set to be part of the future of mobility. This means a powerful battery is the key element: it determines an electric vehicle’s range and weight – and is among the technologies key to significantly reducing CO2 emissions. However, when it comes to battery technology, the German automotive industry is currently heavily dependent on suppliers, mostly from Japan and South Korea. ‘Asian manufacturers are still hugely dominant,’ says Katja Boecker, who is responsible for strategic development for the e-mobility division at BPW Bergische Achsen in Wiehl. A great deal has already been invested in battery research in Germany and there are now some strong centres of expertise. ‘However, cell production in Germany has remained negligible and has not yet been able to compete on the mass market,’ says Boecker. Support from politics and the science sector is helpful in implementing the solutions developed: ‘With support from subsidies and scientific research projects, space can be created to try out and continue developing new technologies,’ says the e-mobility expert.

»With support from subsidies and scientific research projects, space can be created to try out and continue developing new technologies.«

Katja Boecker, e-mobility expert at BPW

Battery research also includes alternatives to lithium

With increasing electrification of the transport industry, this problem may worsen. According to a study by e-mobil BW, the Baden-Württemberg state agency for new mobility solutions and automotives, almost five-and-a-half times the current level of lithium mining would be required if a quarter of the vehicles currently produced were run on electricity.

Promising alternatives: magnesium and sodium

A magnesium battery, for instance, would have key advantages in comparison to conventional lithium-ion batteries: magnesium permits a higher density of energy – and would also be much safer. The use of magnesium would practically rule out battery fires and explosions. It is also 3,000 times more plentiful on earth than lithium and would be cheaper as a result. ‘Magnesium is a promising material and one of the key candidates for our post-lithium strategy,’ says Maximilian Fichtner, deputy director of the Helmholtz Institute Ulm. However, thus far, only basic research in this area is being conducted. We are still far from mass production of this kind of battery.

The same goes for sodium, which the researchers in Ulm also believe to have a lot of potential as a lithium replacement. The mineral is in practically limitless supply on earth – however, a great deal of research is needed before it can be used to produce powerful batteries. So it might be a long time before alternative materials replace lithium. Time in which the raw material might come under increasing demand. The Deutsche Rohstoffagentur (German Mineral Resources Agency) forecasts that in 2025, 111,000 tons of the light metal, now also known as ‘white gold’, will be required worldwide. Three years ago, it was just 33,000 tons.

Battery recycling as a key focus of research

As well as research and development of battery technology, battery recycling is also a key focus of battery research in Germany. ‘Battery recycling is key to fully sustainable e-mobility,’ says MEET head Winter. Naturally, recycling occurs at the end of a lithium-ion battery’s life cycle. Strictly speaking, electric car batteries have three lives: if their charging capacity is no longer suitable for use in electric cars, which – depending on manufacturer performance – may be the case after five to ten years, they are first of all used for around the same time as an electricity storage system: either in private homes whose owners have built solar panels on their roof and want to store the energy they produce temporarily, or as a buffer storage system to stabilise the electricity network. The batteries are only recycled once their capacity is no longer sufficient to do this either. They are then used as replacement parts stocks or raw material supplies for new batteries.

However, the battery recycling procedure has so far been unwieldy. Lithium-ion batteries are hazardous goods which must be transported accordingly. They must be stored according to safety provisions even once they are no longer in use. They are then finally broken down mostly by hand, as consistent battery types would be required for machine disassembly – but manufacturers currently often do not use the same type of battery even for the same model of vehicle.

Furthermore, few batteries are currently designed to be recycled later. Individual components are difficult to separate and rigorous melting is often required. Although experts are seeing many efforts being made on the market to improve the situation, there is still a lack of suitable concepts. Manufacturers and researchers are currently hard at work on these. New concepts for battery recycling are increasingly urgently required, as the growing number of electric cars on the roads is seeing a corresponding increase in the global demand for batteries. This also results in increasing demand for recycling of the valuable raw materials inside the batteries – such as metals like cobalt and platinum, as well as lithium.

Focus on raw material recovery

This was a key reason behind the creation of the research project Automotive Battery Recycling 2020 last year. Funded by the EU, the project is coordinated by the Fraunhofer Institute for Silicate Research ISC in Würzburg. Its aim is to identify eco-friendly and economically viable ways to recycle batteries efficiently for e-mobility and to scale them up for industrial use, according to Andreas Bittner, head of New Business Development at the Fraunhofer ISC. The aim is to improve the entire recycling chain so that valuable raw materials can be recovered and secured for European industry.

Automated disassembly and sorting procedures are considered a key aspect of battery recycling. As well as mechanical crushing processes, such as shredding, researchers are also investigating new procedures such as electro-hydraulic crushing, which, when combined with advanced sorting technology, enables accurately sorted recovery of a wide range of battery materials. ‘Additionally, we are developing concepts for the reuse of entire battery components – not just material components – for fixed purposes, to enable efficient, profitable materials cycles,’ says Bittner.

Researchers at the Fraunhofer Institute in Würzburg are also part of the large-scale European research initiative Battery 2030+, bringing together battery experts from five universities, eight research centres and several industry associations. The aim is to develop new generations of ultra-powerful, reliable, safe and affordable batteries – paying particular attention to the issue of sustainability.

New battery technology for new vehicle classes

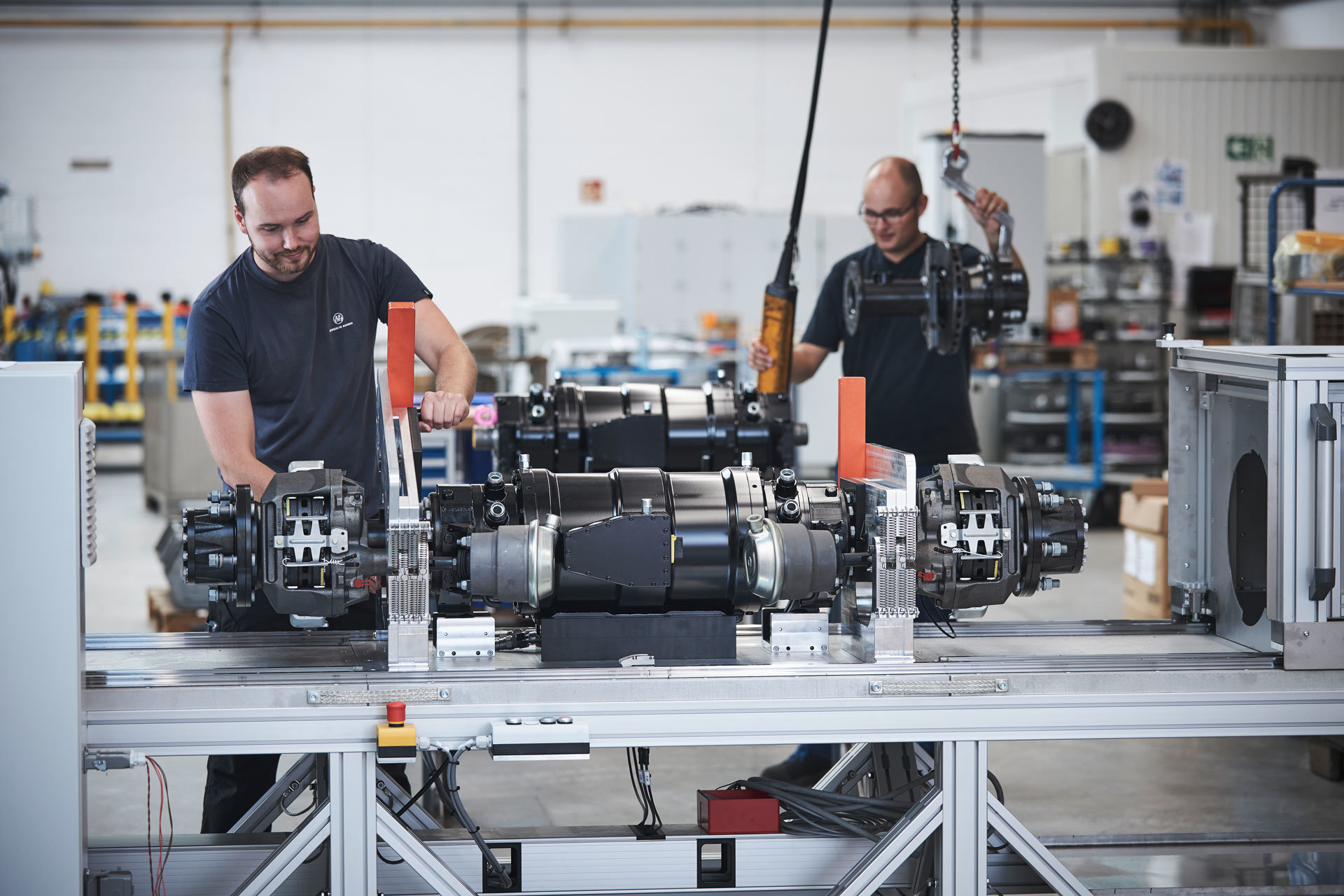

Sustainability also means considering the electrification of more and more new vehicle classes with the help of new battery technology. So far, BPW has only turned ordinary transporters into electric vehicles with the company’s own eTransport axle, and for the most part, they can be found in city centres. ‘These commercial vehicles generally have planned, repeated routes that don’t vary dramatically from day to day or week to week,’ explains BPW expert Boecker. ‘These distances can be covered effectively with the current e-mobility technology.’

In the near future, however, trucks with up to 18 tons of permitted total weight will also be powered by electricity. The research project LiVe at RWTH Aachen, funded by the German Federal Ministry for the Environment as part of the Erneuerbar mobil programme, is set to pave the way for this development. BPW is supplying the drive technology. The first converted vehicle model LiVe1, based on the Isuzu N range, which carries a permitted total weight of 7.5 tons, was launched at the end of last year in Aachen. A modular electrification concept for up to 18 tons is being developed for the end of the coming year. As part of the project, the Chair of Production Engineering of e-Mobility Components (PEM) at RWTH Aachen wants to find out how electric commercial vehicles can be made more economically viable. The key is the agile development method the Chair has adopted: ‘Unlike traditionally lengthy development cycles, it produces results quickly, which can then be tested and optimised,’ explains PEM group leader Gerret Lukas. ‘We want to use a modular system to reduce costs, boost the variety of electric trucks on offer and make the design options more flexible.’

At BPW, there’s great excitement about contributing to this future-forward project as a supplier. ‘The opportunity to work with leading companies on the emissions-free truck of the future in Aachen’s unique research and development environment is an extremely inspiring one,’ says Hans Werner Kopplow, director of development in e-mobility at BPW. ‘This kind of partnership helps emissions-free electric city centre transport in Europe make a breakthrough.’